Roof Depreciation Rate Ato

You must also file form 4562 in the year you first place the roof in service.

Roof depreciation rate ato. Apportionment of borrowing expenses. An item that is still in use and functional for its intended purpose should not be depreciated beyond 90. Electricity supply 26110 to 26400. When a claims adjuster looks at a roof he will consider the condition of the roof as well as its age.

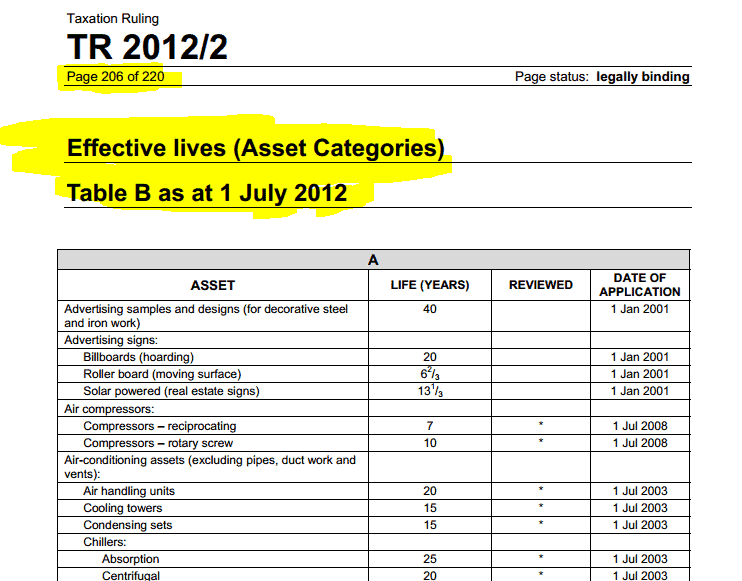

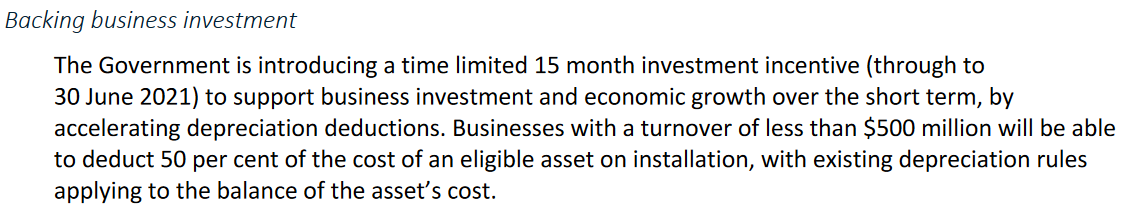

Ato depreciation rates 2020 table a. The irs uses the straight line method to calculate the depreciation of your roof which means that the depreciation of your roof is calculated evenly across a set period of time. Name effective life diminishing value rate prime cost rate date of application. You must also take into account the month the roof is installed for the first year.

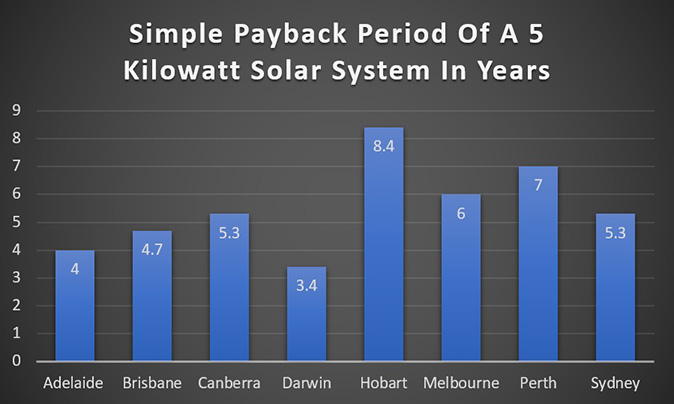

The roof depreciates in value 5 for every year or 25 in this case. For most depreciating assets you can use the ato s determinations of effective life published in taxation rulings updated annually. For example if you install a new roof in august you can claim four and a half months of depreciation for the first year. Roof replacement would it be an improvement or eligible for depreciation discussion in accounting tax started by firsttimebuyer 1st feb 2016.

Let s say your roof is supposed to last 20 years and it s 5 years old when damaged. To all the accountants here we are getting our roofs repaired and repainted and was wondering if this is a repair and maintenance or improvement. Take your annual depreciation deduction and prorate it for the number of months the roof was in service during the first tax year this is the figure you enter in line 18. The 2nd question is if we can cliam it as an outright deduction if it is a repair and maintenance or will it be part of the building.

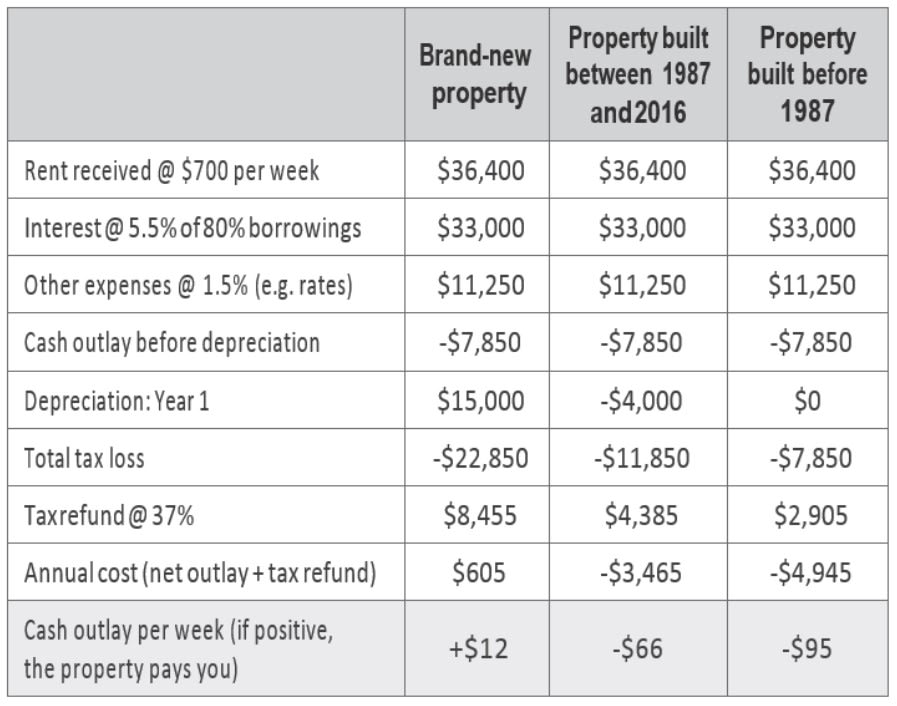

Individual taxpayers report income and expenses for rental properties on schedule e of form 1040. Electricity gas water and waste services 26110 to 29220. Join australia s most dynamic and respected property investment community. The irs states that a new roof will depreciate over the course of 27 5 years for residential buildings and over the course of 39 years for commercial buildings.

The effective life is used to work out the asset s decline in value or depreciation for which an income tax deduction can be claimed. Life expectancy of building components will vary depending on a range of environmental conditions quality of materials quality of installation design use and maintenance. Divide the yearly depreciation of 545 46 by 4 5. You can claim 121 24 for that first year.

.png)

:max_bytes(150000):strip_icc()/abstract-mirror-building-texture-1027237872-b3b9afe0ea6a43298085e6b8710f5c4f.jpg)