Open Llc In Delaware

Agents and corporations inc.

Open llc in delaware. Delaware registered agent requirement. With our llc formation we provide a year of registered agent service. However the delaware llc act requires any company incorporated in delaware to have a delaware registered agent with an in state street address. That will be referred to as your domestic state your business will be considered a foreign entity in states outside your domestic state america has 50 different states and a couple extra jurisdictions.

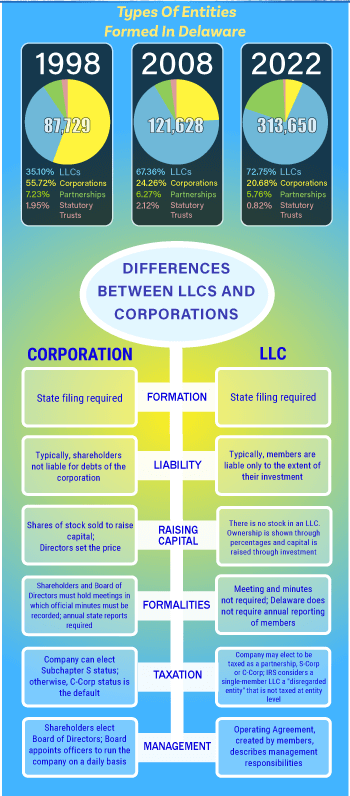

If you live in delaware or do business in the state then this information does not apply to you. Incnow will act as registered agent for companies incorporating in. There is no delaware tax on intangible property. A delaware llc is an extremely flexible business entity with low start up costs and an affordable franchise tax.

In delaware an llc or corporation is formed with the delaware division of corporations. If you don t live in or do business in delaware and you ve heard that you should form an llc in delaware let me save you a lot of money and headaches. Forming an llc in delaware is easy. The disadvantages of forming an llc in delaware far.

You should not form an llc in delaware. You should form an llc in delaware. You can form an llc in delaware without visiting opening an office or maintaining a bank account in delaware. Lp llc gp although limited partnerships limited liability companies and general partnerships formed in the state of delaware do not file an annual report they are required to pay an annual tax of 300 00.

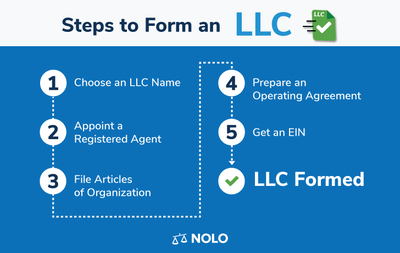

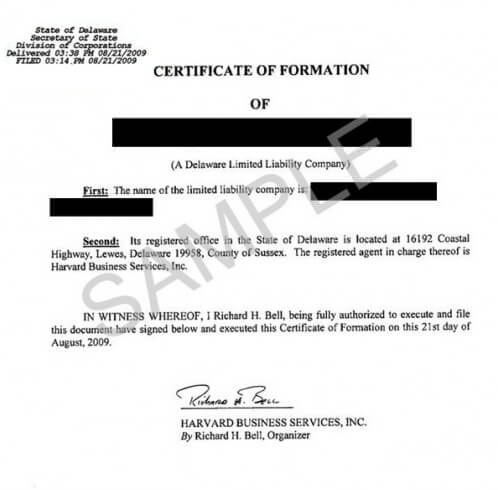

A delaware llc aka delaware limited liability company is a type of business entity that is created by filing the proper certificate of formation with the delaware secretary of state. Llc members who are not delaware residents are not taxed on their share of profits. A delaware llc not doing business in the state does not have to pay state income tax or gross receipts tax but does pay an annual franchise tax and an annual registered agent fee. To form an llc in delaware you will need to file a certificate of formation with the delaware department of state which costs 90 you can apply by mail or in person.

The certificate must include. A delaware llc is created by filing by mail or fax a certificate of formation of limited liability company with the delaware division of corporations. Taxes for these entities are to be received no later than june 1st of each year. Why form a delaware llc.

For those with greater delaware business address needs we also offer mail forwarding and virtual office packages starting at 50 a year.